Investing in LEGO with Investabrick’s Long Term LEGO Investment Strategy

Published: 6 months ago

Last Updated: 5 months ago

ses, which are highly sought after in the resale market. Additionally, members can earn points on purchases that can be redeemed for discounts, enhancing profitability when acquiring investment pieces. At Investabrick one of our main goals is to help people learn how to invest in LEGO and one of our key LEGO investing strategies is long-term LEGO investing.

Long-term LEGO investing embodies a commitment to the enduring value of LEGO sets. Targeting investments for periods extending beyond 3 years, this strategy suits those who see beyond the immediate appeal of LEGO, focusing on its potential for consistent, long-term returns, finding LEGO investments that will continue to appreciate long after the initial post-retirement increase.

What is Long-Term LEGO Investing?

Long-term LEGO investing is about holding LEGO investment sets that are expected to steadily appreciate over the years allowing us to “buy and hold” our LEGOs investments with an expectation of continual profits over a period of at least 3 years (and sometimes substantially longer).

When looking to identify which LEGO sets to buy as a long term LEGO investment we look for some or all of the following:

- LEGO sets that have a strong demand for the whole of their retail shelf life and that demand stays consistent or even increases as retirement approaches

- Sets that had a limited supply whilst at retail sale (often those which were held as LEGO exclusive sets only sold by a small number of retailers in addition to LEGO)

- Sets that have limited, shallow discounting during their time at retail sale

- Sets that come from LEGO investment themes (or sub-themes) which have strong historical trends of providing successful LEGO investments

- Sets from themes we think will continue to be desirable for at least the foreseeable future

- Sets and themes that appeal to LEGO collectors

Whilst long term LEGO investing will benefit from the short term spike that often comes from a set becoming retired LEGO, this is not the key focus of the Investabrick long term LEGO investment strategy as it often can be for shorter term LEGO investments, that’s not to say it doesn’t often provide an initial impetus for our long term LEGO investments, our focus is on the sets that will continue to appreciate in value for years past that point.

Is LEGO a Good Investment for the Long-Term?

LEGO sets offer sustained demand, relatively predictable value growth, and increasing rarity, making them a compelling choice for long-term growth. The strategy's success hinges on the selection of popular often iconic LEGOs investment sets, which maintain their appeal due to timeless themes or significant cultural relevance.

Long term LEGO has seen average growth of over 10% a year but here at Investabrick we are keen to demonstrate that far greater returns can be delivered, including over the long term, with accurate LEGO investment set selection, buying at the right time and price and then doing the same again when selling.

Long-term LEGO investors should conduct thorough research, diversify their investments, and stay updated on market trends and retirement lists. While the goal is to buy and hold, understanding valuation trends can help in determining the best time to sell for maximum return which is critical to any investment strategy, but especially longer term ones. A LEGO investor, and especially a long term one, should not be totally wed to continuing to hold on to their LEGOs investments and be ready to sell a LEGO investment if the market conditions indicate the time is right to do so.

What are the Benefits of Long-Term LEGO Investment?

There are many benefits of long-term LEGO investing including:

- The ability to make substantial profits for a number of years from each individual investment

- A smaller time investment into managing a long term investment LEGO portfolio compared to a shorter term one

- The ability to target LEGO collectors with sets that you know will be in demand and command substantially higher prices in the future

- Far less fees for selling LEGO investment sets than in a portfolio you turn over many more times

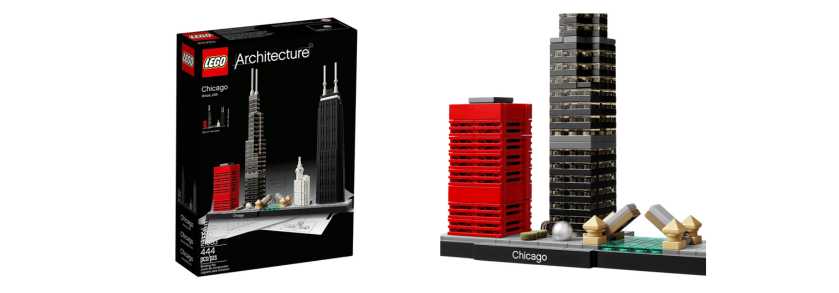

A detailed Example – LEGO Architecture 21033 Chicago

The easiest way for us to demonstrate the potential LEGO investment returns that can be achieved we have worked through a LEGO Architecture set one of our founding members purchased just before it became retired LEGO in December 2018.

He purchased LEGO Architecture Chicago (21033) for $40 just before retirement with the view that such a popular, best selling and high demand set, with a subject matter that was likely to stay popular assuring demand in the future would also be strong.

(If we are being picky, he could actually have bought it $10 cheaper a month or two earlier when it was discounted in the run up to its LEGO retirement!).

That was 5 years ago and LEGO 21033 is now valued at $250, demand is still high and it is a good time to sell and cash in on a vastly successful LEGO investment, delivering LEGO investment returns of 525% in total across the 5 years, which equates to average annualised growth of 44% a year – over $200 of profit from a $40 investment!

Conclusion

Long-term investing in LEGO sets is a unique strategy that combines passion with pragmatism. It requires patience, research, and a genuine appreciation for LEGO. By focusing on sets with potential for long-term appreciation, investors can build a portfolio that delivers not just financial returns but also personal satisfaction.

With a large focus on LEGO investment set selection, purchasing at the right time and price, monitoring the performance over time and then optimising the time and price to sell can lead to maximising you LEGO investment returns.

Investabrick is here to guide you through every step of your long-term LEGO investing journey, ensuring you have the tools and insights needed to achieve your financial objectives, ensuring you focus on which LEGO sets to invest in (and potentially more importantly which sets to avoid!), when and at what price to buy and to sell.

Hopefully this long-term guide to LEGO investing will equip you with the knowledge needed to succeed in the LEGO investment market and enable you to profit from what many people see as just a toy or a hobby. On a regular basis we identify LEGO sets that are well suited to long term LEGO investments and will continue to highlight these opportunities to the Investabrick community.